Voice Agent for Insurance Agencies

Insurance agencies are a high-retention vertical for white-label voice AI resellers, with average client contracts of $397-797/month and retention rates exceeding 85% due to the industry's complex policy inquiry and claims support requirements.

The insurance industry handles over 3 billion customer calls annually in the US alone. Agencies that resell voice AI to insurance clients tap into a market where response time directly impacts customer retention, quote conversion, and claims satisfaction scores.

Which Trillet product is right for you?

Small businesses: Trillet AI Receptionist - 24/7 call answering starting at $29/month

Agencies: Trillet White-Label - Studio $99/month or Agency $299/month (unlimited sub-accounts)

Why Insurance is a Profitable Vertical for Voice AI Resellers

Insurance agencies face persistent staffing challenges that make them ideal voice AI clients: they need 24/7 availability for claims, experience seasonal spikes during enrollment periods, and lose customers to competitors who answer faster.

The business case is compelling:

67% of insurance customers expect a response within 24 hours for non-urgent inquiries

Quote requests abandoned due to slow response cost agencies an estimated $4,200 per lost policy in lifetime value

After-hours claims calls represent 31% of total call volume but often go to voicemail

Agencies with sub-5-minute response times close quotes at 2.3x the rate of slower competitors

When you pitch voice AI to insurance agencies, you are selling customer retention and quote conversion, not technology. This framing shifts the conversation from expense to revenue protection.

What Insurance Clients Need from AI Voice Agents

Understanding insurance-specific requirements helps agencies position their white-label offering effectively and avoid implementation failures.

Inbound Call Handling:

Policy information lookup and basic coverage questions

Claims intake and first notice of loss (FNOL) collection

Payment processing support and billing inquiries

Certificate of insurance (COI) requests

Quote request capture with detailed information gathering

Outbound Capabilities:

Quote follow-up calls to prospects who requested information

Renewal reminder campaigns 30-60 days before policy expiration

Claims status update notifications

Cross-sell campaigns for existing policyholders

Compliance Requirements:

Call recording with proper disclosures

State-specific licensing acknowledgments

Privacy policy adherence for personal information handling

Secure handling of payment and policy data

Trillet's white-label platform includes built-in compliance tools for TCPA, state recording laws, and configurable disclosures that insurance agencies require.

Pricing Insurance AI Services for Sustainable Margins

Insurance represents a stable, recurring revenue vertical where agencies can build predictable income streams.

Recommended Pricing Tiers:

Tier | Monthly Price | Included | Target Client |

Solo Agent | $297-397/month | 1 producer, 400 minutes, basic integrations | Independent agents |

Agency | $497-697/month | 5 producers, 1,500 minutes, CRM sync | Small agencies |

Enterprise | $897-1,297/month | Unlimited producers, 4,000 minutes, custom workflows | Large agencies |

Margin Analysis at Trillet's $0.09/minute Rate:

For a typical Solo Agent client using 250 minutes/month:

Your cost: $299/month (Agency plan, allocated) + $22.50 voice minutes = ~$50-70/client

Your price: $347/month

Gross margin: 80-86%

For an Agency client using 1,200 minutes/month:

Your cost: $108 voice minutes + platform allocation = ~$150/client

Your price: $597/month

Gross margin: 75%

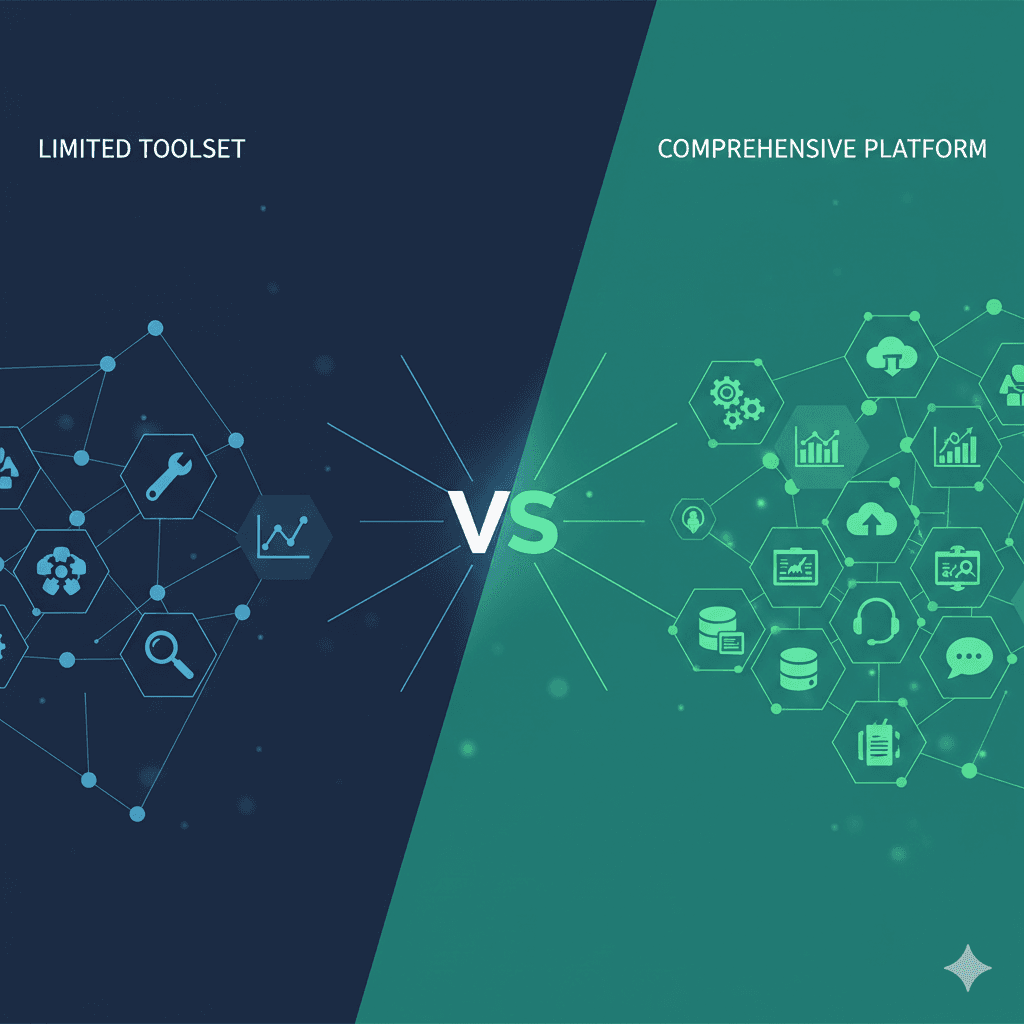

Compare this to Synthflow's $0.12/minute rate and $1,250/month minimum for agency features. The same Agency client would cost $144 in voice minutes alone before platform fees, making Trillet significantly more profitable for resellers.

How to Sell AI to Insurance Agencies

Insurance professionals are risk-averse buyers who require proof and compliance assurances. Generic AI demonstrations fail. Compliance-focused, ROI-driven pitches close.

Opening Script Framework:

"Hi [Name], I help insurance agencies capture the 30% of calls that go to voicemail after hours and during peak periods. Last quarter we helped [similar agency] reduce missed quote calls by 67% and increase their quote-to-bind ratio by 23%. Do you have 20 minutes this week to see if we could do something similar for your agency?"

Key Objection Responses:

"Insurance is too regulated for AI" "We built this specifically for regulated industries. The platform includes compliant call recording disclosures, handles state-specific requirements, and routes complex compliance questions to your licensed staff. Let me show you how another agency in [state] uses it within their compliance framework."

"My clients want to talk to their agent" "Absolutely, and they will. The AI handles routine inquiries, captures quote requests, and collects claims information so your agents can focus on the conversations that require expertise. Your clients get faster service, and your agents spend time on high-value activities."

"What about claims? Those are sensitive" "The AI handles first notice of loss collection, gathering all the required information accurately and empathetically. It then routes the claim to your claims team with complete documentation. No AI makes coverage decisions or denies claims."

Demo Strategy:

Show a mock quote request call with detailed information capture

Demonstrate how policy questions are answered from the knowledge base

Walk through a claims intake scenario with FNOL collection

Display the lead appearing in their CRM with complete details

Show compliance features: recording disclosures, data handling

The compliance-focused demo builds confidence with risk-averse insurance buyers.

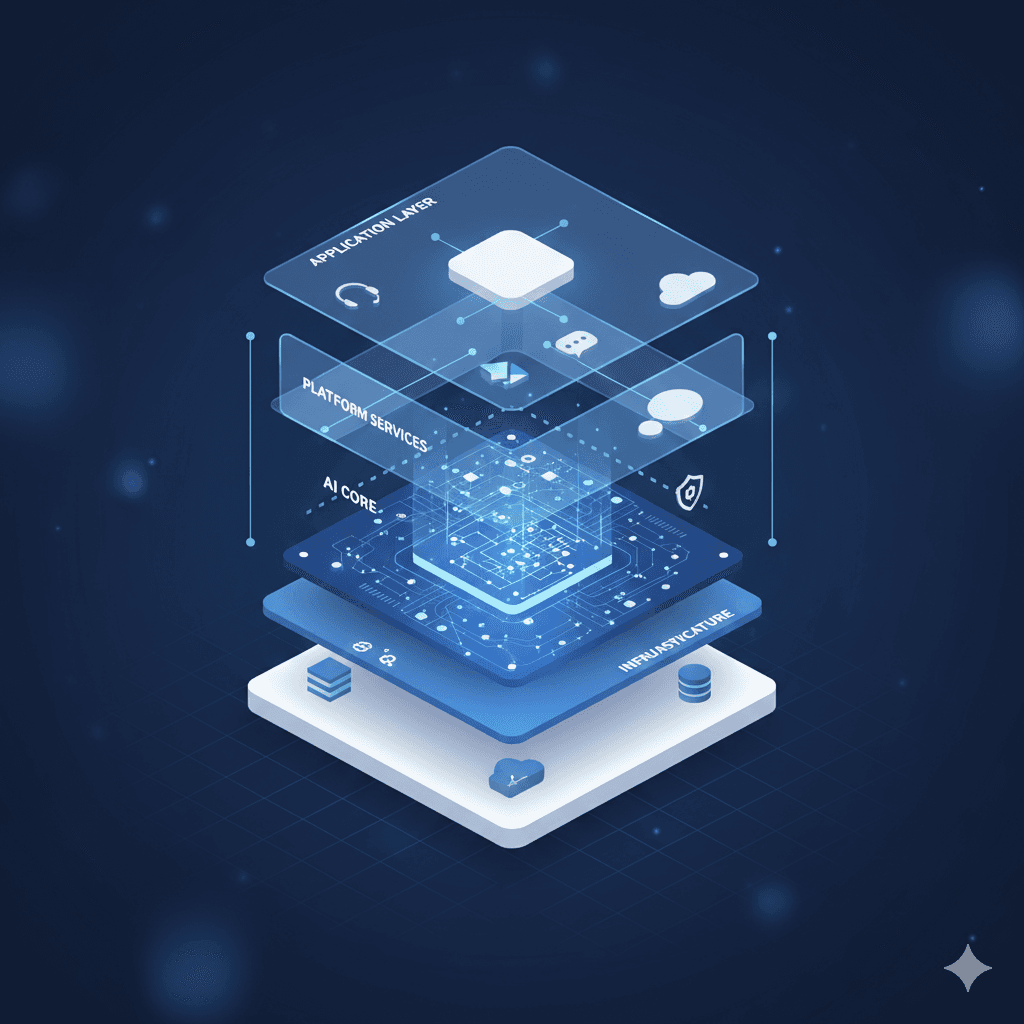

Technical Implementation for Insurance Clients

Agencies need to understand integration requirements to set proper expectations and deliver successfully.

CRM and Agency Management System Integrations:

Applied Epic (via API)

Vertafore AMS360 (via webhook)

HawkSoft (via Zapier)

AgencyZoom (native)

HubSpot (native)

GoHighLevel (native)

Quoting Platform Integrations:

EZLynx (via API)

Rater integrations for comparative quotes

Carrier portals (via webhook notifications)

Calendar Integrations:

Google Calendar

Outlook/Office 365

Calendly

Acuity Scheduling

Payment Processing:

Stripe integration for premium payments

Invoice delivery via SMS/email

Trillet's white-label platform includes native CRM connectivity with HubSpot and GoHighLevel, plus API access for custom integrations with agency management systems. The platform's website scraping feature can automatically import policy information, coverage FAQs, and agency details to accelerate deployment.

Building an Insurance-Focused Agency Practice

Specializing in insurance allows agencies to build deep expertise and referral networks within a regulated industry.

Client Acquisition Channels:

Insurance associations: Partner with local Independent Insurance Agents associations (IIABA chapters)

Agency cluster groups: Pitch to aggregators like SIAA, Iroquois Group, or Keystone

Insurance technology conferences: Exhibit at InsureTech Connect, Digital Insurance events

Carrier programs: Position as a technology partner for carrier agency support programs

LinkedIn outreach: Insurance agency owners are active on LinkedIn

Onboarding Checklist:

Collect common policy questions for each line of business (auto, home, commercial, life)

Import carrier-specific coverage information into knowledge base

Configure FNOL workflows for claims intake

Connect agency management system or CRM

Set up calendar for appointment booking

Configure compliance disclosures for applicable states

Test with sample calls across all major scenarios

Train client staff on dashboard, call review, and escalation procedures

Trillet's website scraping feature accelerates this process. Paste the agency website URL and the platform automatically extracts coverage descriptions, agent information, and service details to train the AI agent in minutes rather than hours.

Compliance Considerations for Insurance AI

Insurance is heavily regulated, and agencies must address specific requirements to avoid liability.

State Licensing Requirements: AI agents must be configured to:

Not provide specific coverage advice or policy interpretations

Disclose that the caller is speaking with an AI assistant

Route coverage questions to licensed agents

Never make statements that could be construed as binding coverage

Recording Consent: Insurance calls are typically recorded for quality and compliance. Ensure:

Call recording disclosure at the start of each call

Two-party consent handling for applicable states (California, Florida, etc.)

Recording retention per state insurance regulations

Secure storage with appropriate access controls

Data Privacy:

Handle personal information per state privacy laws

Implement proper data security for SSNs, policy numbers, payment information

Configure data retention policies aligned with client requirements

Claims Handling:

AI should collect FNOL information only, not make coverage determinations

Configure clear handoff to licensed claims staff

Document all claims-related communications

Trillet's platform includes built-in compliance tools for TCPA, state-specific recording laws, HIPAA (for health insurance agencies), and configurable disclosures that satisfy insurance regulatory requirements.

Measuring Success and Reducing Churn

Insurance clients stay when they see measurable impact on their core metrics. Build reporting into your service from day one.

Key Metrics to Track:

Metric | Target | Why It Matters |

Quote request capture rate | 90%+ | Direct revenue impact |

After-hours call handling | 100% answered | Competitive advantage |

Average response time | Under 30 seconds | Customer satisfaction |

Claims FNOL completion | 95%+ complete data | Reduces follow-up calls |

Renewal reminder contact rate | 80%+ | Retention driver |

Monthly Reporting Template:

Send clients a monthly report showing:

Total calls handled (with breakdown by type: quote, claims, service, billing)

Quote requests captured with conversion tracking if available

Claims intakes completed with average data completeness

After-hours calls handled (quantify the value of coverage)

Customer satisfaction scores if measured

Comparison to previous month with trend analysis

When a client sees "Your AI captured 47 quote requests this month, representing approximately $28,200 in potential annual premium at your average policy value," retention becomes straightforward.

Vertical-Specific Use Cases

Insurance agencies have diverse needs based on their lines of business.

Personal Lines (Auto, Home, Renters):

Quote request capture with vehicle/property details

Policy change requests (adding drivers, updating coverage)

Billing inquiries and payment processing

Claims intake for auto accidents, property damage

Commercial Lines:

Certificate of insurance (COI) request handling

Audit scheduling and preparation

Complex quote intake with business information

Claims FNOL for commercial losses

Life and Health:

Enrollment period support (ACA, Medicare)

Premium payment processing

Beneficiary change requests

Basic coverage questions with licensed agent handoff

Benefits and Group:

Open enrollment support

Employee coverage inquiries

Claims status updates

Provider network questions

Position your services based on the agency's primary lines of business. A commercial-focused agency has different needs than a personal lines agency, and your pricing and deployment should reflect this.

Frequently Asked Questions

Can AI agents handle complex insurance questions?

AI agents can answer common policy questions from configured knowledge bases covering coverage types, claim processes, and agency services. For questions requiring policy interpretation or coverage advice, the AI qualifies the inquiry and schedules a callback with a licensed agent rather than providing potentially inaccurate information.

Which Trillet product should I choose?

If you are an insurance agent wanting AI call answering for your own agency, start with Trillet AI Receptionist at $29/month. If you are an agency wanting to resell voice AI to insurance clients, explore Trillet White-Label with Studio at $99/month (up to 3 sub-accounts) or Agency at $299/month (unlimited sub-accounts). ai/enterprise) provides fully managed implementation with custom SLAs.

How does the AI handle claims intake?

The AI follows configured FNOL workflows to collect required information: date/time of loss, description of incident, parties involved, policy number, and contact details. It asks clarifying questions to ensure data completeness, then routes the claim documentation to your claims team. The AI does not make coverage determinations or claim decisions.

What about compliance with state insurance regulations?

Trillet's platform includes configurable compliance features: call recording disclosures, state-specific consent handling, data privacy controls, and customizable scripts that ensure the AI operates within regulatory requirements. Agencies should configure the AI to route coverage questions to licensed staff and avoid making statements that could be construed as advice.

How long does it take to deploy for a new insurance client?

Most agencies deploy new insurance clients within 2-5 business days. Initial setup using website scraping takes minutes, but insurance deployments require additional configuration for policy-specific knowledge bases, claims workflows, and compliance settings. Complex deployments with agency management system integrations typically take 5-10 business days.

Conclusion

Insurance agencies represent a stable, high-retention vertical for agencies reselling white-label voice AI. The combination of regulatory complexity, 24/7 service requirements, and clear ROI on quote capture creates a market where specialized solutions command premium pricing.

Agencies building an insurance practice can achieve 75-86% gross margins while delivering measurable results that drive client retention. The key is positioning the AI as a compliance-friendly customer service and quote capture tool that handles volume while licensed staff focuses on high-value conversations.

Start with Trillet White-Label at $299/month for unlimited sub-accounts and $0.09/minute voice rates to build a profitable insurance agency practice.

Related Resources: