Native Stripe Billing: How to Automate Client Invoicing for Voice AI Services

Native Stripe billing integration eliminates manual invoicing for voice AI agencies, automatically charging clients based on usage while you retain full margin control and real-time revenue visibility.

Managing client billing manually creates administrative overhead that eats into agency profits. As your voice AI client base grows from 5 to 50 accounts, invoicing becomes a full-time job. Native Stripe integration solves this by automating the entire billing cycle from usage tracking to payment collection.

Which Trillet product is right for you?

Small businesses: Trillet AI Receptionist - 24/7 call answering starting at $29/month

Agencies: Trillet White-Label - Studio $99/month or Agency $299/month (unlimited sub-accounts)

What Is Native Stripe Billing for Voice AI Agencies?

Native Stripe billing connects your white-label voice AI platform directly to Stripe's payment infrastructure, automating client charges without third-party middleware.

Unlike manual invoicing or Zapier-based workarounds, native integration means:

Real-time usage data flows directly to Stripe

Client credit cards are charged automatically at your set intervals

Failed payments trigger automated retry sequences

Revenue dashboards update instantly

No CSV exports or manual reconciliation required

For agencies running voice AI services, this translates to predictable cash flow and dramatically reduced administrative burden.

Why Manual Billing Fails at Scale

Manual billing creates compounding problems as agencies grow. At 10 clients, sending invoices takes a few hours monthly. At 50 clients with variable usage, it becomes a multi-day accounting exercise.

Common manual billing pain points:

Usage data scattered across multiple dashboards

Calculation errors on per-minute charges

Delayed invoicing causing cash flow gaps

Chasing late payments instead of closing new deals

No visibility into which clients are profitable

One agency owner reported spending 15 hours monthly on billing administration before implementing automated billing. That time now goes toward client acquisition and retention.

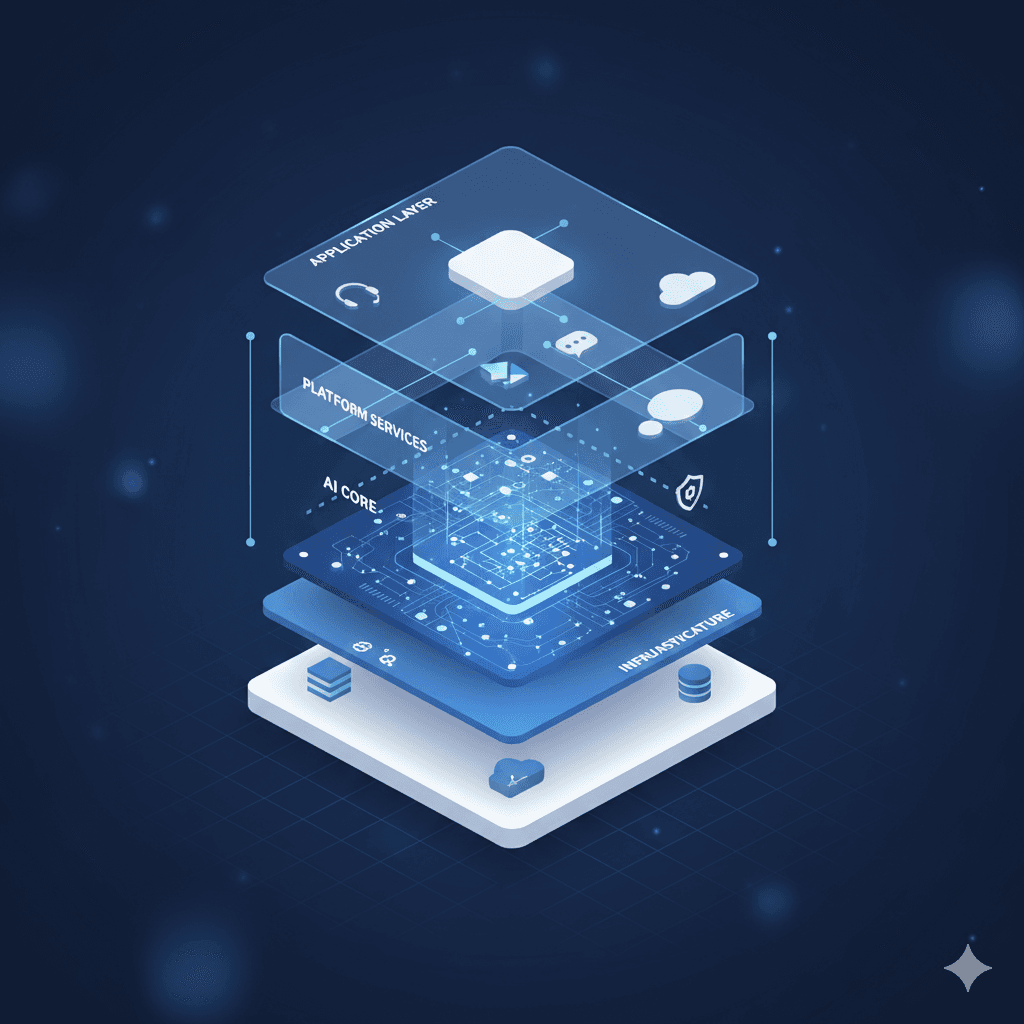

How Native Stripe Integration Works

Native Stripe billing operates through direct API connections between your voice AI platform and Stripe's payment infrastructure.

The automated billing cycle:

Usage tracking: The platform records every minute of voice AI usage per client sub-account

Rate application: Your configured pricing tiers are applied automatically

Invoice generation: Stripe creates invoices based on usage plus any fixed fees

Payment collection: Client payment methods are charged on your billing schedule

Revenue recognition: Payments post to your Stripe dashboard in real-time

This happens without manual intervention. You set the rules once, and the system handles execution.

Setting Up Client Pricing Structures

Effective Stripe billing requires clear pricing architecture. Most successful voice AI agencies use tiered structures that balance simplicity with profitability.

Popular pricing models for voice AI services:

Model | Structure | Best For |

Flat monthly | $297-997/month all-inclusive | Predictable usage clients |

Usage-based | $0.25-0.50/minute | High-volume or variable clients |

Hybrid | Base fee + overage | Most agency clients |

Tiered packages | Bronze/Silver/Gold | Simplified selling |

With Trillet's native Stripe integration, you configure these pricing structures within the platform. The system then applies them automatically to each client's usage.

Example hybrid pricing setup:

Base fee: $297/month (includes 500 minutes)

Overage rate: $0.35/minute

Your cost: $99/month platform + ~$45 usage at $0.09/minute

Your margin: $153/month minimum (51%+)

Comparing Billing Approaches

Not all billing solutions deliver equal results. Understanding the trade-offs helps agencies choose the right approach.

Feature | Native Stripe | Zapier Integration | Manual Invoicing |

Setup complexity | Low | Medium | None |

Ongoing maintenance | None | Monthly checks | Weekly hours |

Usage accuracy | Real-time | Delayed sync | Error-prone |

Payment collection | Automatic | Semi-automatic | Manual follow-up |

Failed payment handling | Automated retry | Varies | Manual outreach |

Reporting | Built-in | Requires setup | Spreadsheets |

Cost | Included | $50+/month | Your time |

Native integration eliminates the reliability concerns that plague middleware solutions. When Zapier workflows break at 2 AM, you discover it when clients complain about incorrect charges.

Revenue Visibility and Reporting

Stripe's dashboard becomes your agency's financial command center when using native billing integration.

Key metrics available in real-time:

Monthly recurring revenue (MRR) across all clients

Per-client profitability analysis

Churn indicators (failed payments, usage drops)

Revenue growth trends

Average revenue per account (ARPA)

This visibility enables data-driven decisions. When you can see that Client A generates $500/month profit while Client B barely covers costs, you can adjust pricing or service levels accordingly.

Handling Failed Payments

Payment failures happen. Credit cards expire. Bank accounts get flagged. Native Stripe integration handles these situations automatically.

Automated dunning sequence:

Initial charge attempt fails

Stripe sends payment failure notification to client

Retry attempts occur over 7-14 days (configurable)

If all retries fail, service can be automatically paused

Once payment succeeds, service resumes

This removes awkward "your payment failed" conversations from your plate. The system handles collection while you maintain client relationships.

Security and Compliance Considerations

Handling client payment data carries responsibility. Native Stripe integration addresses compliance requirements built-in.

Security features included:

PCI DSS Level 1 compliance (Stripe handles card data)

No credit card numbers stored on your platform

Tokenized payment methods

Encrypted data transmission

Audit trails for all transactions

You never see or store actual credit card numbers. Stripe manages all sensitive payment data, reducing your compliance burden significantly.

Implementation Timeline

Getting native Stripe billing operational is straightforward for agencies using platforms with built-in integration.

Typical setup process:

Connect Stripe account (5 minutes)

Configure default pricing tiers (15 minutes)

Set billing cycles and retry rules (10 minutes)

Apply pricing to existing clients (varies)

Test with a pilot client (1-2 days)

Most agencies complete initial setup in under an hour. The pilot period confirms everything works before rolling out to all clients.

Frequently Asked Questions

How does native Stripe billing differ from using Zapier?

Native integration means direct API connection without middleware. Data flows in real-time without sync delays. When Zapier experiences outages or workflow limits, your billing continues uninterrupted with native integration.

Can I set different pricing for different clients?

Yes. Native billing supports per-client pricing configurations. You can charge Client A $297/month flat while billing Client B $0.35/minute based on their usage patterns and negotiated rates.

What happens if a client disputes a charge?

Stripe's dispute process handles chargebacks. You receive notification, can submit evidence, and Stripe manages communication with the card issuer. Detailed usage logs from your platform serve as documentation.

Which Trillet product should I choose?

If you're a small business owner looking for AI call answering, start with Trillet AI Receptionist at $29/month. If you're an agency wanting to resell voice AI to clients, explore Trillet White-Label. Studio at $99/month (up to 3 sub-accounts) or Agency at $299/month (unlimited sub-accounts).

How quickly do payments post to my account?

Standard Stripe payout timing applies, typically 2-7 business days depending on your country and account history. Stripe Express accounts may have faster access.

Conclusion

Native Stripe billing transforms voice AI agency operations from manual invoicing chaos to automated revenue collection. The combination of real-time usage tracking, automatic payment collection, and built-in reporting eliminates administrative overhead that prevents agencies from scaling.

For agencies serious about growth, automated billing is not optional. It is infrastructure. The time saved on invoicing and payment collection directly converts to capacity for client acquisition and service delivery.

Explore Trillet White-Label to see how native Stripe integration simplifies agency billing. With pricing starting at $99/month for Studio (3 sub-accounts) or $299/month for Agency (unlimited sub-accounts) plus $0.09/minute usage, the platform provides the billing automation agencies need to scale profitably.

Related Resources: