AI Receptionist for Financial Advisors

An AI receptionist answers financial advisor calls 24/7, qualifies prospective clients, and books consultations while you focus on portfolio reviews and client meetings.

Financial advisors face a constant tension between serving existing clients and capturing new ones. You're in a portfolio review when a potential high-net-worth client calls. You're analyzing market movements when someone wants to discuss retirement planning. Every unanswered call is a prospect who may not call back, choosing the advisor who picked up instead.

The stakes are higher than most industries. Financial advisory relationships often span decades and involve six or seven-figure portfolios. The first impression matters enormously, and reaching voicemail when someone is ready to discuss their financial future sends the wrong message about your availability and service level.

Which Trillet product is right for you?

Financial advisors: Trillet AI Receptionist - 24/7 call answering starting at $29/month

Financial planning firms and networks: Trillet White-Label - Resell to your advisor network starting at $99/month

Why Do Financial Advisors Struggle with Missed Calls?

Prospective clients researching financial advisors typically contact only 2-3 firms before making a decision, and most choose the first advisor who responds professionally.

The nature of financial advisory work creates constant scheduling conflicts. Client meetings run long when discussing complex estate planning. Market volatility demands immediate attention. Compliance documentation takes hours. Meanwhile, your phone rings with potential new clients who have finally decided to seek professional advice.

Consider what happens when someone calls about wealth management:

They've likely experienced a life event (inheritance, business sale, retirement)

They're ready to have a serious conversation about their finances

They want to assess whether you're the right fit

Voicemail feels inadequate for discussing their financial future

An AI receptionist answers every call instantly, asks appropriate qualifying questions, and schedules consultations directly into your calendar while maintaining the professional tone your practice requires.

What Can AI Receptionist Do for Financial Advisors?

AI handles the initial conversation that determines whether a prospect becomes a client or disappears forever.

When a potential client calls, the AI can:

Greet callers professionally with your practice name

Ask qualifying questions (assets under management range, financial goals, timeline)

Explain your services and investment philosophy

Answer common questions about your approach

Schedule initial consultations based on your real-time availability

Send SMS confirmations with your office details

Capture caller information for follow-up

The AI learns your specific practice through website scraping. It understands whether you specialize in retirement planning, high-net-worth individuals, business owners, or comprehensive financial planning, and tailors conversations accordingly.

How Does AI Qualify Financial Advisory Prospects?

Proper qualification ensures you spend consultation time with prospects who match your ideal client profile.

AI qualification for financial advisors typically covers:

Service fit questions:

Are you looking for comprehensive financial planning or investment management?

What's prompting you to seek a financial advisor now?

Do you currently work with a financial advisor?

Basic eligibility:

What's your approximate investment portfolio size?

Are you primarily focused on retirement, wealth building, or estate planning?

What's your timeline for making a decision?

Urgency indicators:

Have you recently experienced a financial event (inheritance, sale, etc.)?

Are you comparing multiple advisors?

When would you like to schedule an initial consultation?

This information arrives in your inbox before the meeting, so you can prepare relevant questions and demonstrate immediate understanding of their situation.

What Questions Can AI Answer for Financial Advisory Clients?

AI handles the repetitive questions that consume your day, freeing you for complex advisory conversations.

Common questions AI answers accurately:

What services do you offer?

Do you charge a flat fee or percentage of assets?

What's your minimum investment requirement?

Are you a fiduciary?

How often do you meet with clients?

Do you specialize in any particular area?

What's your investment philosophy?

The AI pulls these answers from your website and training materials, ensuring consistency with your messaging. For questions about specific investment recommendations or personalized advice, it schedules a consultation rather than overstepping appropriate boundaries.

Comparison: AI Receptionist vs Hiring Staff

Feature | Trillet AI | Part-Time Receptionist | Answering Service |

Monthly cost | $29-99 | $2,500-4,000 | $200-500 |

Hours covered | 24/7/365 | 20-30 hours/week | Business hours |

Financial services knowledge | Trained on your practice | Requires extensive training | Generic scripts |

Calendar booking | Automatic | Manual | Usually not included |

Prospect qualification | Customizable questions | Inconsistent | Basic message taking |

SMS follow-up | Included | Not typically | Extra cost |

Simultaneous calls | Unlimited | 1 at a time | Queue system |

For an independent financial advisor, the math is straightforward. One additional client per year from better lead capture can generate $5,000-15,000+ in annual fees, easily covering decades of AI receptionist costs.

How Does AI Handle After-Hours Financial Inquiries?

After-hours calls often represent your most serious prospects, as these are people researching financial advisors when they have time to think carefully about their future.

The AI handles evening and weekend calls identically to business hours:

Professional greeting mentioning your practice

Full qualification conversation

Direct calendar booking for your next available slot

Immediate SMS with confirmation and your office details

Email summary sent to you for morning review

Many financial advisors find that 30-40% of prospect calls come outside business hours. These callers are often high earners with demanding schedules who research financial matters during personal time. Without AI coverage, these prospects go to competitors or lose momentum overnight.

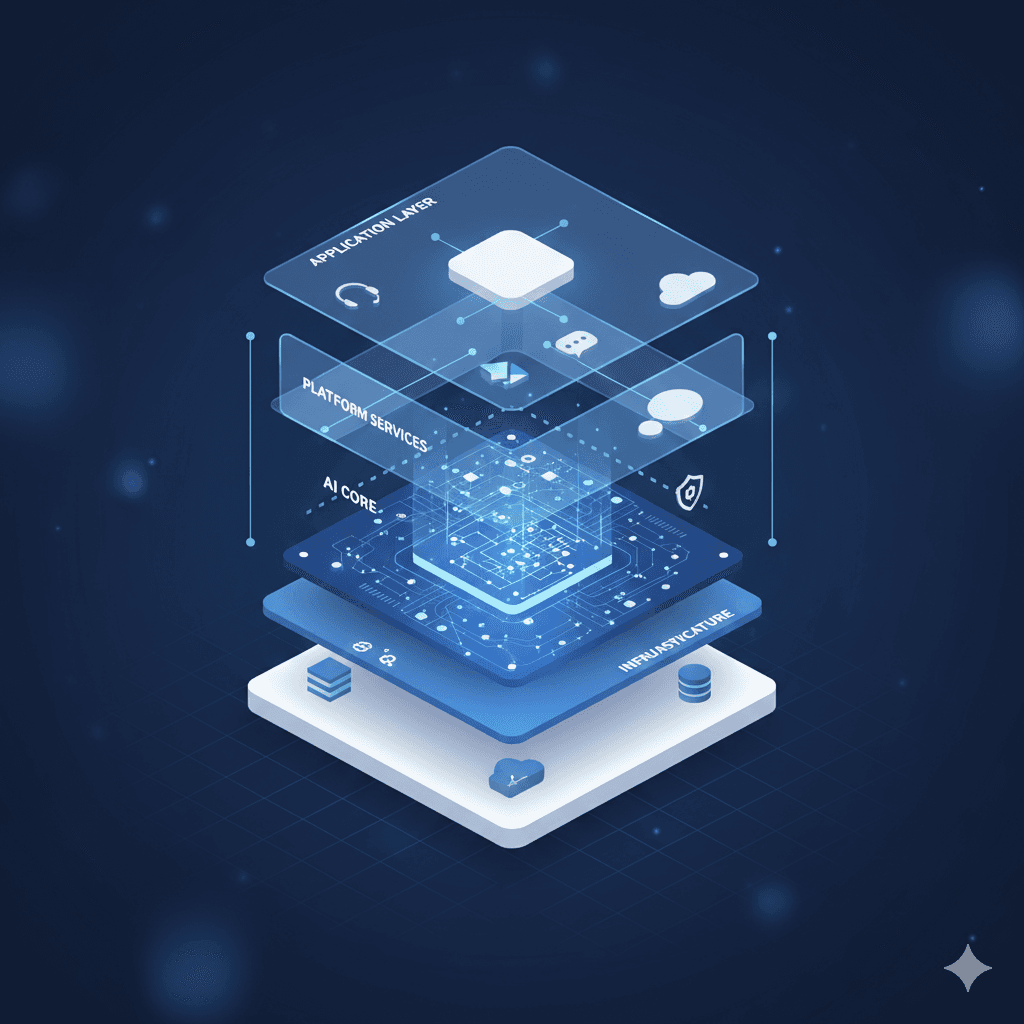

Can AI Integrate with Financial Advisory Tools?

Yes. AI receptionist services connect with the tools financial advisors already use.

Trillet integrates with:

Google Calendar and Outlook for appointment scheduling

HubSpot for lead tracking

GoHighLevel for automated follow-up sequences

SMS for instant confirmations and reminders

Email for detailed call summaries

When a qualified prospect books a consultation, the information flows directly into your CRM. No manual data entry, no lost details, no leads falling through the cracks.

What About Compliance and Client Confidentiality?

Financial advisors operate under strict regulatory requirements, making compliance and confidentiality essential.

Trillet includes built-in compliance features:

Call recording with proper disclosures (where required by your jurisdiction)

Data handling aligned with privacy requirements

No investment advice given by AI (handled only in direct consultations)

Secure data transmission and storage

The AI collects contact and qualification information only. Actual financial discussions, recommendations, and document collection happen during your direct consultation. This maintains appropriate separation between lead capture and regulated advisory services.

Frequently Asked Questions

How quickly can I set up AI receptionist for my financial advisory practice?

Setup takes about 5 minutes. The AI scrapes your website to learn your services, specializations, and approach. You can customize qualifying questions and business hours immediately, and start receiving calls the same day.

Will callers know they're speaking with AI?

Modern AI voices sound natural and professional. Most callers focus on getting their questions answered rather than analyzing who's answering. The AI introduces itself appropriately and handles conversations with the professionalism your practice requires.

Which Trillet product should I choose?

If you're an individual financial advisor or small practice looking for AI call answering, start with Trillet AI Receptionist at $29/month. If you're a financial planning firm wanting to offer AI receptionist service to your advisor network, explore Trillet White-Label with Studio at $99/month (up to 3 sub-accounts) or Agency at $299/month (unlimited sub-accounts).

Can AI handle calls from existing clients?

AI can take messages and schedule callbacks for existing clients. For portfolio questions or specific account matters, it routes callers to you directly or takes detailed messages so you can follow up with the relevant information.

What happens if someone asks for investment advice?

The AI acknowledges that investment advice requires a direct consultation with you and offers to schedule a meeting. It never provides specific investment recommendations, ensuring compliance with financial services regulations.

Conclusion

For financial advisors, every missed call is a potential long-term client relationship lost to a competitor who answered faster. AI receptionist service ensures you capture every inquiry, qualify prospects before you meet, and book consultations automatically while you focus on serving existing clients.

At $29/month, Trillet costs less than an hour of most advisors' time. Start your free trial at Trillet AI Receptionist and stop losing high-value prospects to voicemail.

Related Resources: